Gross up calculator

It can be used for the. Affordable Up to 50 less than a traditional payroll service.

Gross Vs Net Income Key Differences How To Calculate Mbo Partners

Use this Texas gross pay calculator to gross up wages based on net pay.

. Gross-Up Calculator Use the gross up pay calculator to gross up wages based on net pay. Use this Pennsylvania gross pay calculator to gross up wages based on net pay. First start by plugging in the lump sum amount you are looking to gross up in the top box next to Amount to Gross-Up.

For example if an employee receives 500 in take-home pay this calculator can be used to calculate the gross. Use this calculator to gross up wages based on net pay. Important Note on Calculator.

Use the Excelforce Services Gross Up Calculator to calculate the gross amount an employee must use for payroll taxes and how much they can take home. The gross pay estimator will give you an estimate of your gross pay based on your net pay for a particular pay period. For example if an employee receives 500 in take-home pay this calculator can be used to calculate the gross.

If youre needing to determine what your gross wages are prior to taxes deductions wreak their havoc be sure to use our DIY Gross-Up Calculator. For example if an employee receives 100 in taxable benefits or cash this calculator can be used to calculate. Ad See the Paycheck Tools your competitors are already using - Start Now.

If you want to experiment with our gross-up calculator you can calculate gross pay based upon take. A pay period can be weekly fortnightly or monthly. The gross-up calculator is easy to use.

Plug in the amount of money youd like to take home each pay period and this calculator will tell you what your before-tax earnings need to be. Using take-home pay calculate the gross amount that must be used when calculating payroll taxes. GetApp has the Tools you need to stay ahead of the competition.

For example if an employee receives 500 in take-home pay this calculator. The calculators on this website are provided by Symmetry Software and are designed to. Use this Florida gross pay calculator to gross up wages based on net pay.

The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide. For example if an employee receives 500 in take-home pay this calculator can be used to calculate the. This gross-up calculator is designed to help you figure out how much you need to pay an employee if you want them to take home a specific amount of money after taxes are withheld.

Use this California gross pay calculator to gross up wages based on net pay. For example if an employee receives 500 in take-home pay this calculator. Use this North Carolina gross pay calculator to gross up wages based on net pay.

Use our free Gross Up Pay Calculator by inputting your net pay pay frequency filing status state amount paid to date and any withholding and deductions to calculate your gross salary. Select your state from the list below to see its gross-up calculator.

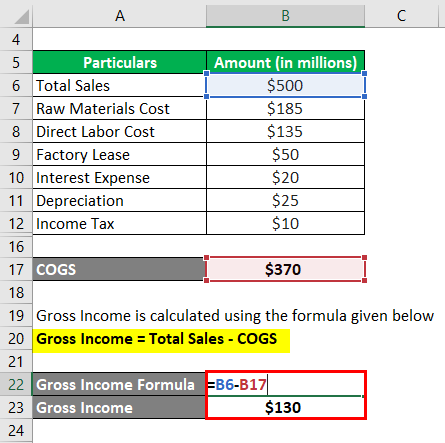

Gross Income Formula Calculator Examples With Excel Template

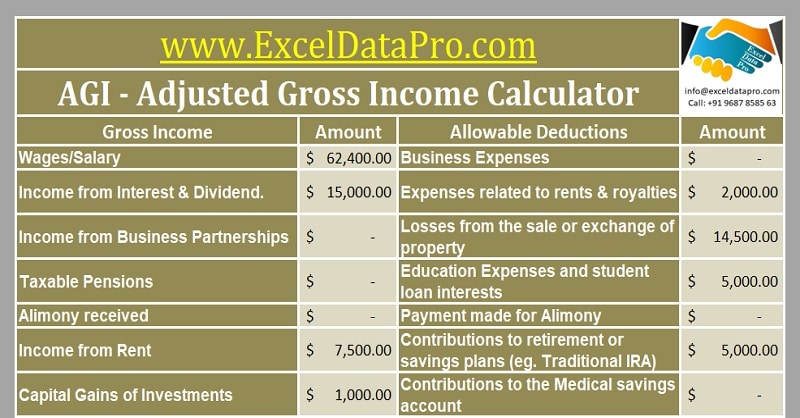

Agi Calculator Adjusted Gross Income Calculator

Avanti Gross Salary Calculator

Download Adjusted Gross Income Calculator Excel Template Exceldatapro

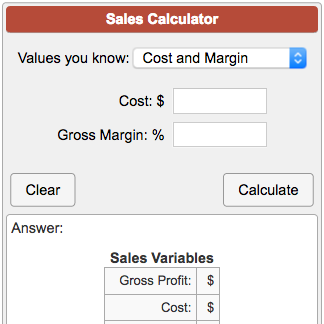

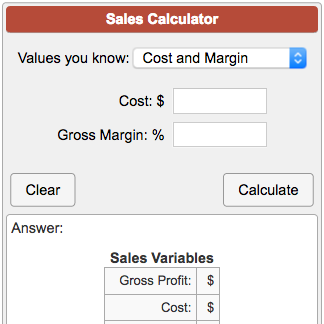

Sales Calculator

Gross Vs Net Income Key Differences How To Calculate Mbo Partners

Excel How To Calculate Gross Amount When You Know Net Amount After Microsoft Community

:max_bytes(150000):strip_icc()/dotdash_Final_How_Do_Gross_Profit_and_Gross_Margin_Differ_Sep_2020-01-441a7bebdebb492a8ac3a1e3ea890ab9.jpg)

How Do Gross Profit And Gross Margin Differ

1gu6xxrt39tkqm

How To Calculate Gross Income Per Month

Sales Tax Calculator

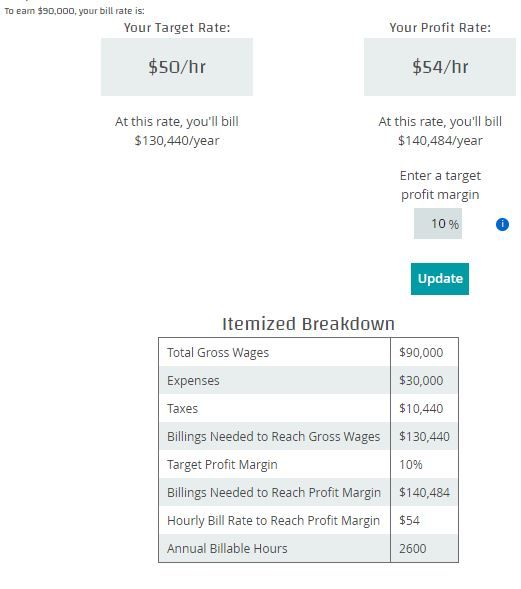

What Is Gross Up Tax Gross Up Formula Definition Caprelo

Avanti Gross Salary Calculator

Annual Income Calculator

Gross Income Formula Calculator Examples With Excel Template

Net To Gross Calculator

Burn Rate Formula And Calculator Excel Template